Messenger apps and conversational AI will develop a significant impact on the client experience of banking. Financial institutions are busy establishing robo-chatbots for service requests or use AI-supported human conversation to support their relationship managers (RMs).

This development is not only a – long overdue – adjustment to the client’s preferred channels. Adoption to conversational banking becomes the decisive factor for banks to stay competitive with their service costs against new challenger banks.

What is conversational banking?

Conversational banking means the inclusion of messaging apps – with all their native abilities to communicate in text, voice and rich formats – into a bank’s client experience. Given the intensity of a conversational style service, AI-powered chatbots have to jump in and answer the bulk of repetitive questions. This will free up human agents for non-standard requests. In the case of wealth management, the goal may be to sustain in-person communication. Here, natural language detection offers the potential to support relationship managers in engaging their clients in effective conversations.

Banks start to integrate AI-powered chatbots as well as AI-supported human conversation into their client experience. This trend has clearly been sparked by a shift in the usage of mobile communication from SMS to instant messaging. And while many industries embraced the opportunity of messenger apps from the very beginning, the financial industry had a more conservative take on that matter.

All existing ways to interact with a bank forced clients to use channels which are owned by their bank: branches, contact centres, ATMs, web banking, mobile banking apps. One defining characteristic of a conversational banking solution is to break through these boundaries and include messaging services and voice assistants into the bank’s universe. This involvement entirely changes the style of communication, as clients can use natural language and their preferred channels when speaking to their bank. Or, in other words, requests that used to be a self-service task for the client become part of a natural conversation.

While the inclusion of messaging apps is the common denominator of a conversational banking strategy, the actual design of a solution leaves room for differentiating approaches. For retail segments, where client requests are numerous, but repetitive, a fully AI-powered chatbot is the envisaged solution. This segment is, indeed, the spot in the market where efficiency potential is the highest and where adoption has set in first.

However, conversational banking does not necessarily strive to replace the in-person conversation with a relationship manager. Highly personalized advisory for HNWI and UHNWI individuals will see a shift to conversational banking, too. Rather than powering a chatbot to replace in-person communication, AI will be applied to support the RM.

Why is conversational banking important?

There are three major drivers pushing financial institutions and wealth managers to make their services available on messaging channels.

Client demand

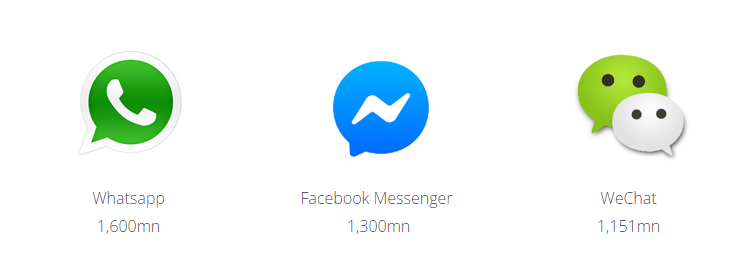

Successful service providers simply must be where the clients are. And this is, increasingly so, on their mobile phone. Consumers averaged a daily 3 hours and 40 minutes on mobile in 2019, up 35% since 2017 (Annie, A., The State of Mobile 2020). Companies from every vertical are benefiting from making mobile the centre of their digital transformation investments. With WhatsApp (1,600m), Facebook Messenger (1,300m) and WeChat (1,151m), the market has three messaging apps that recorded more than a billion monthly active users in 2019 (wearesocial).

Gartner predicts that by 2021, 15% of all client service interactions globally will be fully handled by AI. (Gartner) The predicted saving potential for businesses using bots is $8 billion by 2022 (Deloitte). One can only guess where these figures will be in the years to come for the financial industry, with its many repetitive client inquiries. Requests for account balances, exchange rates and stock prices, but also traditional web banking user support, contain a huge potential for AI-driven client service. Financial institutions who miss out on this trend will find themselves, in a few year's time, with massively higher service costs compared to the market.

Compliance

There is no doubt that conversation between relationship managers and wealth management clients has already shifted to messaging apps. The simple fact that both sides value the convenience of messaging for informal exchange is enough to trigger this development. But how is an RM meant to react when the topic in a WhatsApp chat changes to an investment proposal? Given the increasingly strict regulations on asset suitability and appropriateness, as well as the need to document investment proposals properly, this scenario is a compliance manager's nightmare. Therefore, to include the RM's messaging activities in a secure, compliant and monitored environment ranks high on the priority list of compliance departments.

How to design a conversational banking experience

When planning a conversational banking solution, several success factors must be properly addressed:

Deliver client experience

The design of the client’s endpoint is somehow given by the defined interface of the respective messaging app. But if a service provider can leverage all the possibilities a messaging app offers, it enhances the client’s experience to a great extent. An example is the decision of how to reply to a request for an account balance. A simple text message with the relevant number may be the fastest way to answer the question. But if a client asks for the latest bookings at the same time, a PDF with an account statement may be a better option. This careful design of each use case is key to ensuring a convenient banking experience.

Make RMs want to adopt

Every conversation needs two sides to come into existence. It is, therefore, surprising how many solutions miss the opportunity to improve not only the client experience, but also the experience of bank agents and relationship managers. Most organizations start with a hybrid solution of AI-powered and human interaction, where the AI is the first touch point with the client. Whenever a sensitive request or isolated case pops up in a conversation – a bank agent can jump in and handle the chat. Some solutions, such as our Avaloq Engage App, are not directed at replacing in-person advisory, but are designed to empower wealth manager's advisors in their daily work. Successful implementations of conversational banking strategies offer convenient tools for an RM. This includes easy-to-use access to client information from within the chat and a section with curated news and investment topics in a ready-to-share format. Even administrative tasks can be automated – e.g. by detecting KYC relevant data within a conversation and proposing how to update the CRM with these new facts.

Being understood is the successful start to every meaningful discussion – and the biggest challenge for AI-supported banking journeys.

Detect client intent

Being understood is the successful start to every meaningful discussion – and the biggest challenge for AI-supported banking journeys. A cognitive solution in a chat needs a robust sophisticated design and intensive training to detect customer intent. If the intent remains unclear, tactics such as giving examples or asking for clarification and confirmation are needed to make sure that the intent detection is done properly. Only if the intent has been detected with sufficient certainty can clients be led into a predefined interaction to fulfill their needs. Weak detection of client intent leads to a poor experience and numerous cases where human agents need to intervene.

Ensure privacy and security

The challenge of security aspects arises when the client journey requires sending client or transaction data through a messaging app. While it is in the hand of the financial institution to embed the RM’s or chatbot's endpoint in a secure and compliant environment, it's up to regional regulations and client agreements as to whether the information can be received in a compliant way. If a certain client journey requires switching from the messaging app to a native mobile banking app, this action should be made available in a seamless, convenient way, like a deep-link into the banking app.

Closing

The change that AI and chatbots will bring to client service within the next years is fundamental. Banking was not in the vanguard of this development over the previous years, while other consumer and service industries have already enjoyed a head start, thanks to less complex products and lower regulatory restrictions. However, the changed communication behaviour of clients and ever-increasing margin pressure will force the financial industry to adopt these new technologies. If established banks and wealth managers don't adapt their services, then the change will be brought to clients by challenger banks and fintechs responding faster to this technical opportunity.