At our recent Townhall meeting with NEC’s leadership, we discussed many exciting synergies between Avaloq and our new parent company. Our clients have much to look forward to.

We were welcomed, one and all, into the NEC family by President & CEO Takayuki Morita san and Senior Executive Vice President Akihiko (Kiko) Kumagai san. Now part of a 120-year-old company, we’ve taken a powerfully secure global position from which we can serve our clients.

Technologically, we have enabled ourselves to advance quickly. In many ways, Avaloq and NEC each fill gaps in the other’s repertoire, allowing us to optimize our solutions company-wide for the benefit of all our clients.

I’ll get to specifics in a moment but, before we do, it’s important to understand why NEC and Avaloq are such a good fit as companies.

A shared vision

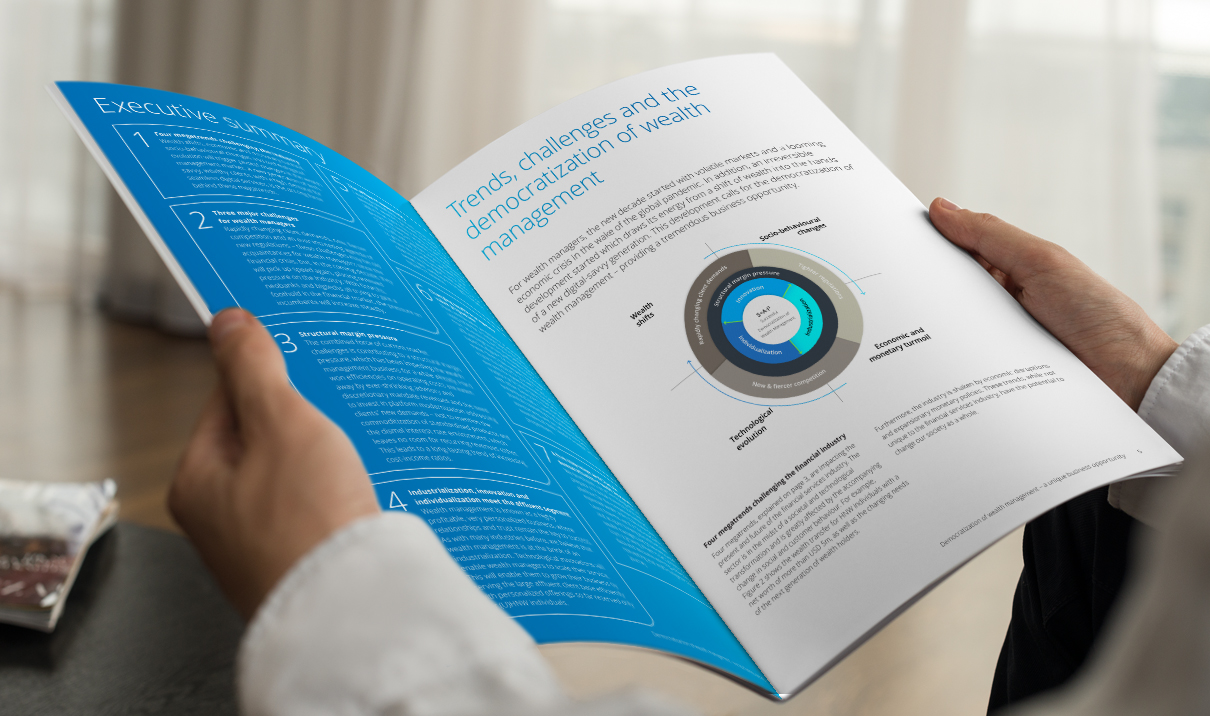

Avaloq’s mission is “to reinvent finance for the people and make a difference in society,” while NEC sets out to “orchestrate a brighter world.” We both hope to transform society through technological innovation. Avaloq aims for the “democratization of wealth management,” and NEC wishes to create a world where “everyone has the chance to reach their full potential.”

Our synergies arise from these profound alignments. Culturally, Morita san asks us to “think simply, be passionate, move fast, and be optimistic.” Simplicity and optimism will enable us to positively impact our clients and our society through our business initiatives.

As one global company, we are better positioned to achieve these high ambitions. Think of NEC as an orchestra playing a better world into existence and of Avaloq as an additional instrument joining the ranks of the ensemble.

Combining technologies for the benefit our customers

Our Townhall meeting brought to light many ways our companies can harmonize our efforts. Morita san explained, “When I'm talking with new members like Avaloq, I always say, I'm not asking for something from you. Rather, I'm asking you to grow using NEC's resources.”

He generously invited us to access NEC’s technical prowess. Of course, we will reciprocate, but let me start with a few examples of how NEC’s capabilities will impact Avaloq’s customers.

NEC has outstanding capabilities in security and analytics that we will use to enhance products we already offer. For example, NEC’s advanced digital identity verification, biometrics, eKYC and cybersecurity expertise will enable us to maintain the highest security standards across our banking and wealth management products even as we make them more widely accessible.

Kiko san noted that NEC’s strengths in analytics utilizing Artificial Intelligence “should add value to Avaloq's solutions,” and we expect that they will. NEC’s leadership in blockchain technology, with one of their primary research groups based in Germany, will enable us to bring innovative applications to our customers sooner and more securely.

Avaloq’s capabilities will benefit NEC’s customers as well. One of NEC’s main goals is to build safer and smarter cities through the digitalization of the public. The way Avaloq has digitalized finance will serve as a model and inspiration for this. “We want to create repeatable platforms,” Morita san said. “In this context, Avaloq is very strong and very advanced.” Avaloq will also enable NEC to outperform competitors globally in banking and financial management, two crucial aspects of this initiative.

Focus on the customer and win

Morita san wants all of NEC to “be more customer centric and more customer focused,” and I couldn’t agree more. Our common vision and our complementary technologies will enable us to serve our customers in significant new ways. This will be a beautiful symphony.