Cloud adoption has accelerated worldwide thanks to more familiarity, a better understanding and proven implementations. As with other sectors, in recent years wealth management firms have been facing huge pressure to improve operational efficiency and performance.

Winds of Change

According to IDC's Innovation in Wealth Management Survey (June 2018), 84% of wealth managers said in the next few years they will primarily focus on operational efficiency due to increased process complexity and costs, especially in the middle and back offices. However, when it comes to tackling these issues, each region has its own approach due to cultural trends, regulations and local market dynamics.

In Asia, for example, 94% of wealth managers said their main driver of cloud adoption was to boost digital innovation in their organizations and find more cost-effective ways to serve their clients (such as digital sales and omni-channel experience). In Western Europe, however, 65% said they are using cloud computing to cut IT expenses and improve IT performance.

Despite the differences, there are still some common trends in cloud adoption across the regions.

1. Security

When it comes to adopting an open solution or connected platform, security is top of mind. According to the survey, 9 out of 10 Western European and Asian wealth managers said this is the major challenge. Threats such as data leaks, fraud and cyberattacks are keeping players away from this technology. Also, IT obsolescence, complex systems architectures and IT budget constraints are affecting how wealth managers are able to overcome this obstacle.

2. Regulation

Every country or region has a different regulatory framework to ensure security protocols, data privacy and business continuity. This can be challenging for companies that are in multiple jurisdictions or for those planning to expand operations abroad. In Asia, for instance, 56% of surveyed wealth managers cited regulation as one of the main reasons holding back broader adoption. The figure in Western Europe was very similar, at 53%. An example of this in Europe is the effort to harmonize and standardize data protection protocols under the General Data Protection Regulation (GDPR) but still provide flexibility for aspects of the regulation to be adjusted by individual member states. Asia, meanwhile, remains very fragmented by country-specific regulations, and the same applies to the US with the California Consumer Privacy Act (CCPA).

3. Cloud Learning Curve

As with any new process, there is a learning curve that wealth managers need to tackle when it comes to adopting this new technology in terms of developing new people skills, deploying the IT solution and the time to obtain the results. This applies to regulators too, as they will need to understand how to create the right conditions for all participants, promoting new standards that firms can implement without having a strong impact on their operations.

These three factors have led to slow cloud adoption from a regional perspective. The lack of clear standardized regional/global guidance regarding data governance, data management frameworks and IT governance are elements that companies need to develop and evaluate before implementing the technology. As a result, there is a lack of innovation in the sector. Wealth managers are just imitating what others are doing and are waiting for more clarity on these issues. But the clock is ticking, and new competitors are getting into the market with more competitive business models.

Tailwinds

From 2015, after the publication of cloud security standards and reference architectures by the National Institute of Standards and Technology (NIST), the International Organization for Standardization (ISO) and the US Department of Defense (DoD), cloud adoption started to pick up as companies began to overcome the obstacles and became more familiar with the technology.

Adoption differs by region, however. In Europe, for instance, we have seen a slight change in business priorities in recent years, moving from a focus on regulatory compliance to efforts to boost operational efficiency. In other words, Western European wealth managers are focused on increasing operational efficiency but are still concentrating on the back office (core banking modernization, shared infrastructure, trading settlements, etc.).

In Asia, however, wealth managers are using digital innovation to boost the front office and middle office, using integrated portfolio management solutions, data analytics and stronger risk management tools. This is helping wealth managers to deliver data-driven solutions to their clients, establishing partnerships with third parties such as fintechs and transforming go-to-market strategies.

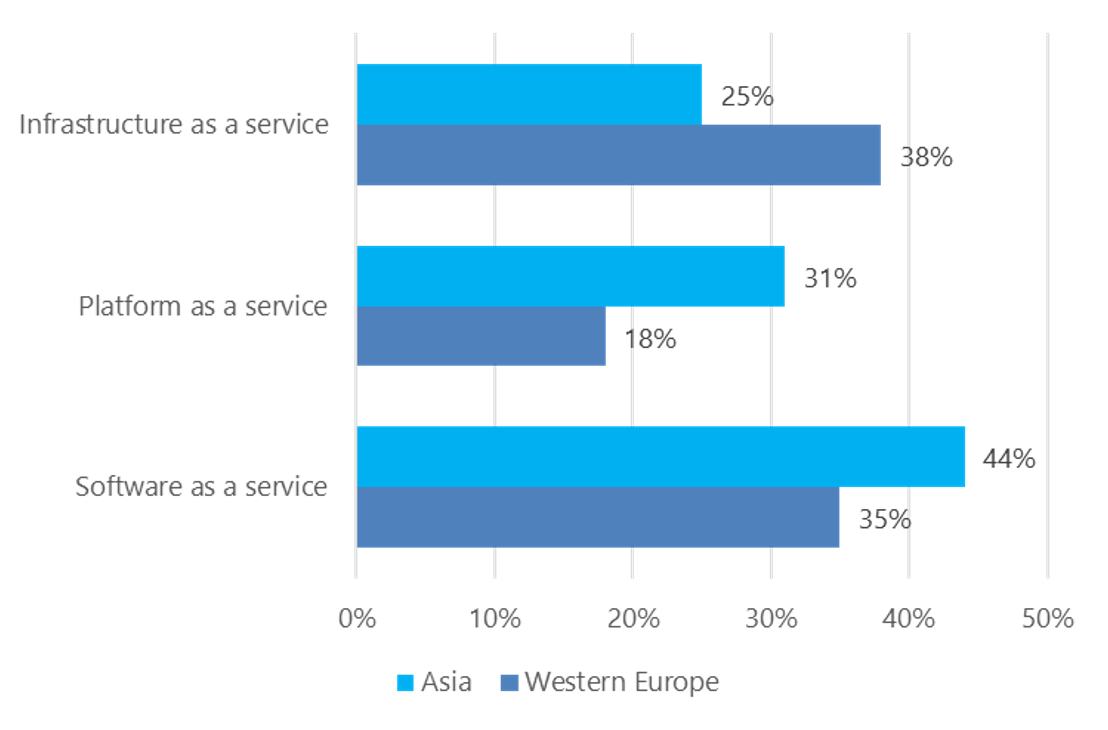

Another essential element to consider is the operating model that each region adopts based on its current needs and market dynamics. As we can see in Figure 1, Asian wealth managers are planning to adopt more software as a service as their main operating model, while their European peers will still have a mix of software as a service and infrastructure as a service. This suggests that Asian wealth managers are more open to sharing data and network control with their third parties than are their European counterparts.

But one thing is for sure: this is where global wealth managers will be allocating resources to improve their operational efficiency through cloud computing, creating a more connected and open financial ecosystem.

Figure 1: What operating model does your company expect to use for technology-driven innovation in the next 10 Years?

Embracing the Change

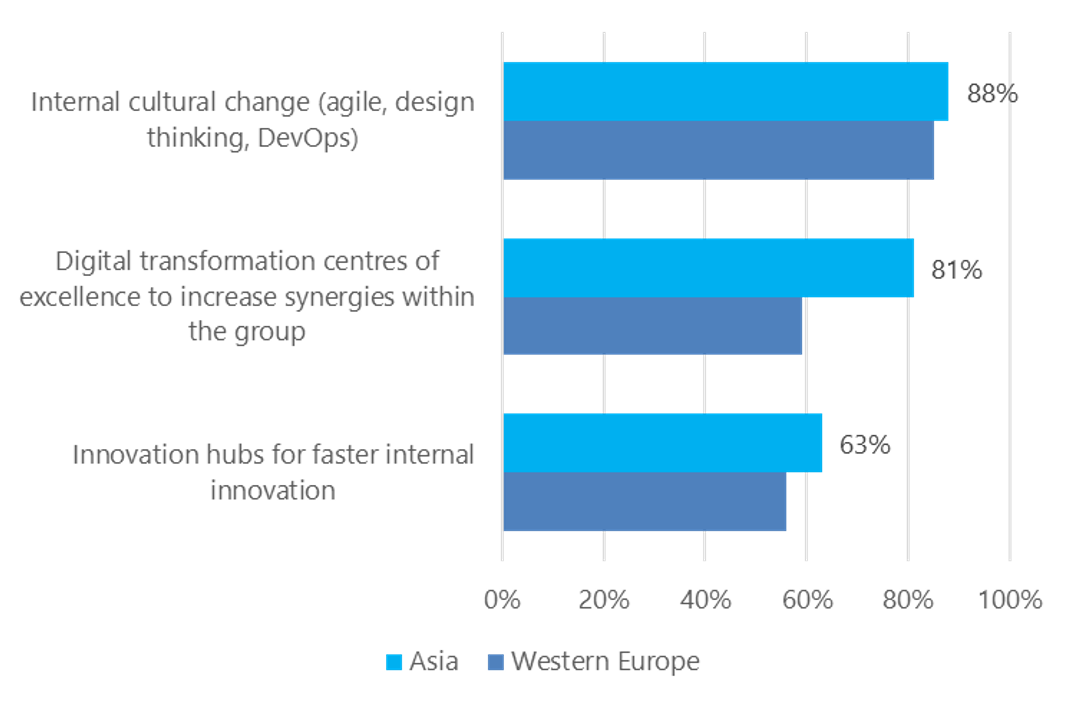

A key consideration for wealth managers is how to drive digital innovation and cultural change to minimize business impact during the adoption period. In the survey we asked wealth managers how they will promote innovation in their firms, with the results shown in Figure 2.

Figure 2: How will your firm drive innovation? (Top 3)

As the figure shows, both regions are using agile methodology and design thinking as their main tool to promote internal cultural change. In second and third place, organizations are choosing digital transformation initiatives such as "centres of excellence" and creating "innovation hubs" to boost their internal transformation processes.

These results indicate that wealth managers in Asia and Europe are well aware of the current lack of innovation in their firms, and that they are working to reverse the trend by adopting cloud platforms to create more customer-centric solutions, boost internal operational efficiency and potentially partner more with third parties.

Download another whitepaper from IDC

For some years now the wealth management sector has been facing enormous pressure to improve operational efficiency, performance and compliance, while neglecting an essential long-term growth driver: innovation.

In this IDC whitepaper you can learn

- How wealth management firms see the opportunity to increase operational efficiency.

- The importance of digital platforms and open ecosystems

- The new operating models and how cloud services such as BPaaS and SaaS are proving enablers for innovation

© Copyright 2019 IDC. Reproduction is forbidden unless authorized. All rights reserved.